I already struggle to receive payments as a freelancer in India. Clients can take anything from weeks to months just to clear small payments. Most delay it because of company processes, and others, well, others just don’t care enough to pay freelancers on time.

When you work from home all the time, it can be a challenge to invoice clients and also make sure that you are receiving payments for freelance work in India. On top of that, if you have to wait for another month just for your payment to get cleared by the bank, then things can become even more problematic.

Luckily, many payment options have cropped up in the last few years making it easy for you get paid, even when you are receiving payments from foreign clients.

Receiving payments for freelance work from Indian clients

Direct bank transfer

Transaction fee: Zero

For Indian clients, direct bank transfer is the easiest way to receive payments. The clients can initiate NEFT or IMPS. While NEFT may take up to one business day to clear out payments, IMPS transactions are cleared instantly. There might be some charges for IMPS but that is chargeable on the client’s end and the exact charges depend on the client’s bank.

All you need to do is provide your clients with your bank account number and IFSC code for this. I believe that it’s one of the best payment method for Indian freelancers because it’s easier for you to manage your finances and file taxes at the end of the financial year.

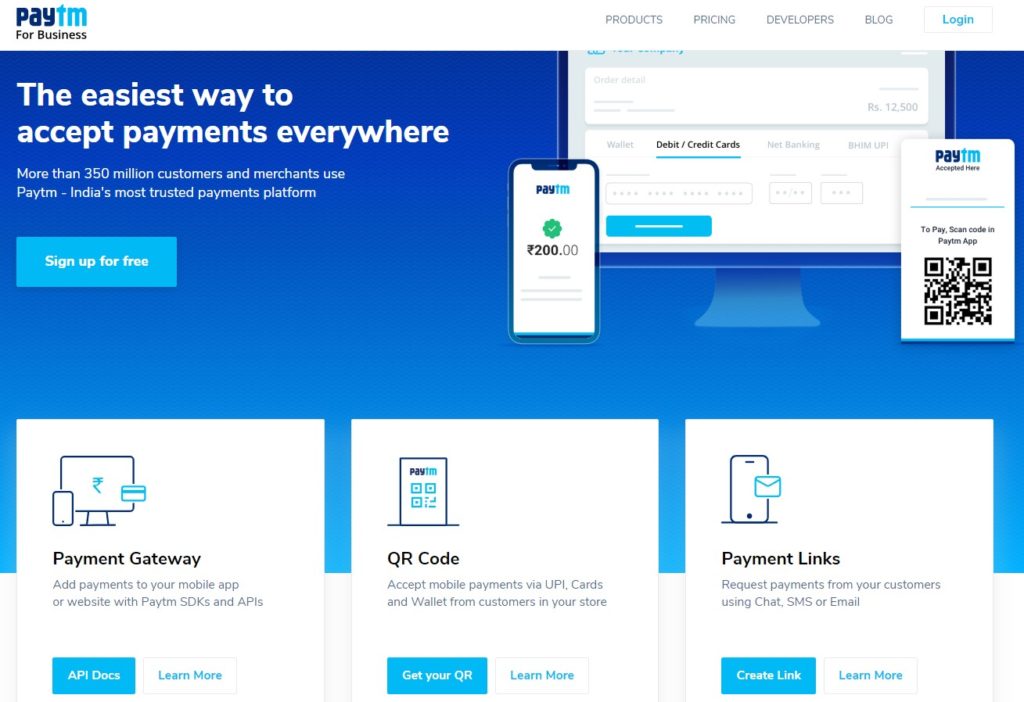

PayTM

Transaction fee: 4%

PayTM is the quickest way to receive payments, provided you and your clients have PayTm accounts with KYC done. You can also create a business account to generate customized QR codes and payment links that you can then share with your clients.

While PayTM may be useful for receiving small amounts, I wouldn’t recommend it for receiving large payments because of the 4% transaction fee that you have to pay if you transfer your PayTM money into your bank account.

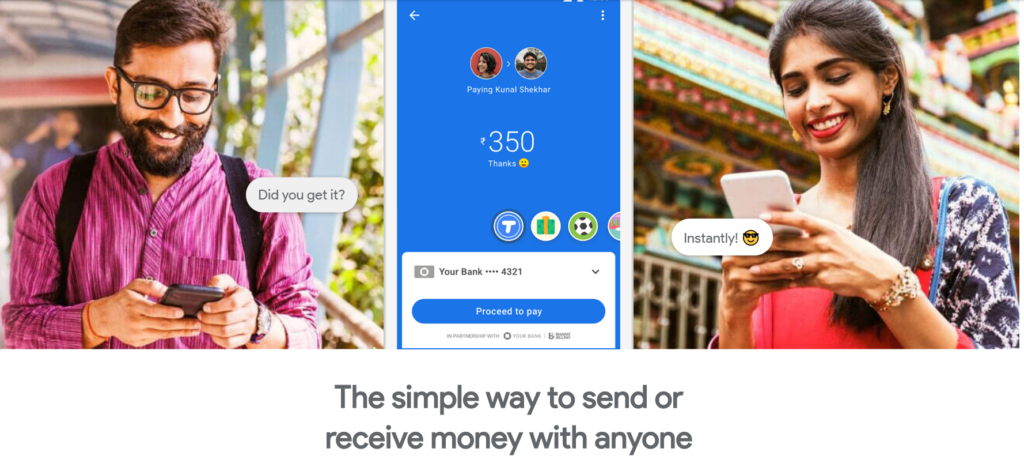

Google Pay

Transaction fee: Zero

Google Pay (Tez) is a great alternative to PayTM as you can pay or receive money using your existing bank account. When a client makes payment to your mobile number through Google Pay, the money gets instantly deposited into your bank account. There are no transaction charges or KYC process involved.

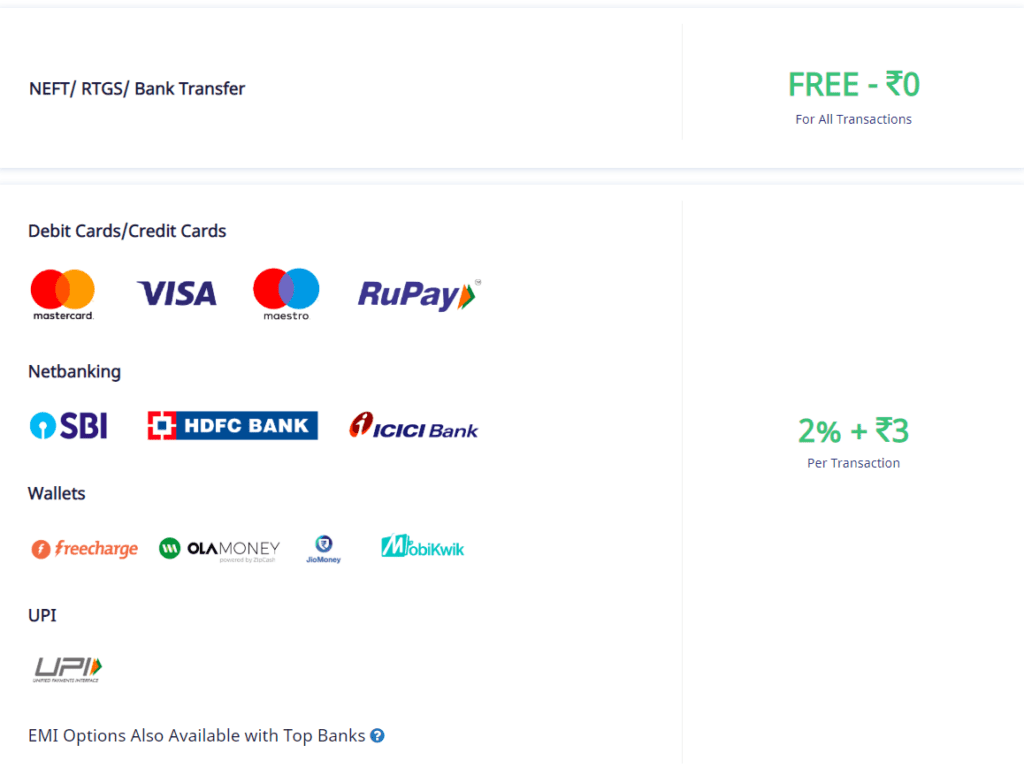

Instamojo

Transaction fee: 2% + INR 3

With Instamojo, you can create customized payment links and share them with your clients (PayPal also has this feature, but it doesn’t support INR payments and many Indian debit cards). So for clients who are based in India, they can use their Indian debit or credit card to make instant payments to you

Instamojo supports a wide number of cards, wallets, and netbanking options.

Receiving payments from foreign clients

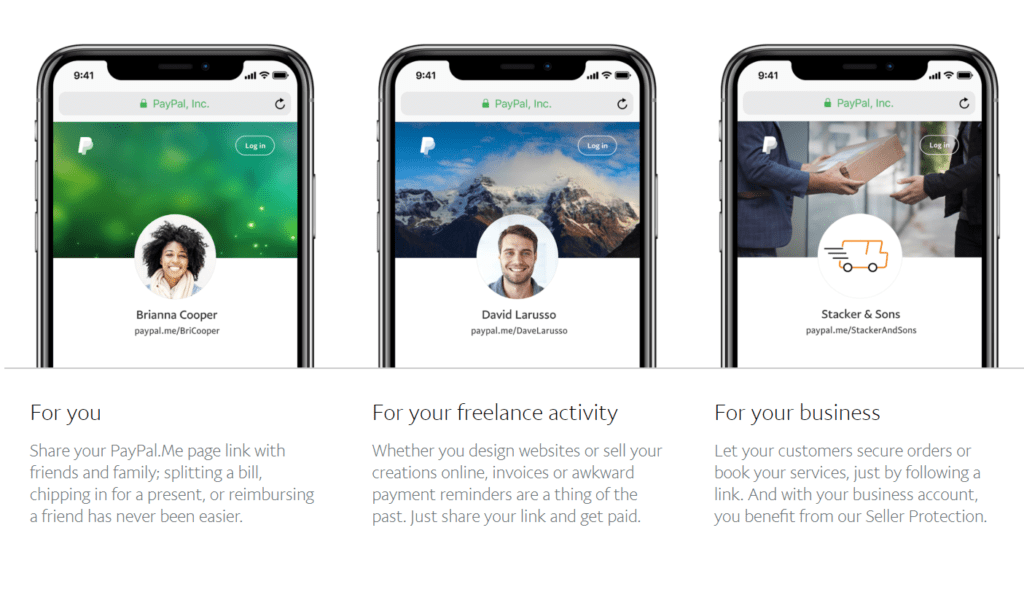

PayPal

Transaction fee: 10%

PayPal for freelancers is definitely the most reliable and oldest payment methods. In fact, I have been using using PayPal for freelance work ever since I started freelancing. But the reason it’s not always my first choice is because of its steep transaction fee.

If a client transfers $100 to me through PayPal, I actually receive $90 only.

Not to mention, the conversion rates offered by PayPal are also much lesser than the actual real-time conversion rates. That means, for every $100 that a client pays, I may just end up receiving about $80.

That being said, I really like PayPal.me which allows me to create custom payment links and share them with my clients. For instance, here is my PayPal link. All I have to do is embed it in the emails or invoices and the clients can make direct payments through the link.

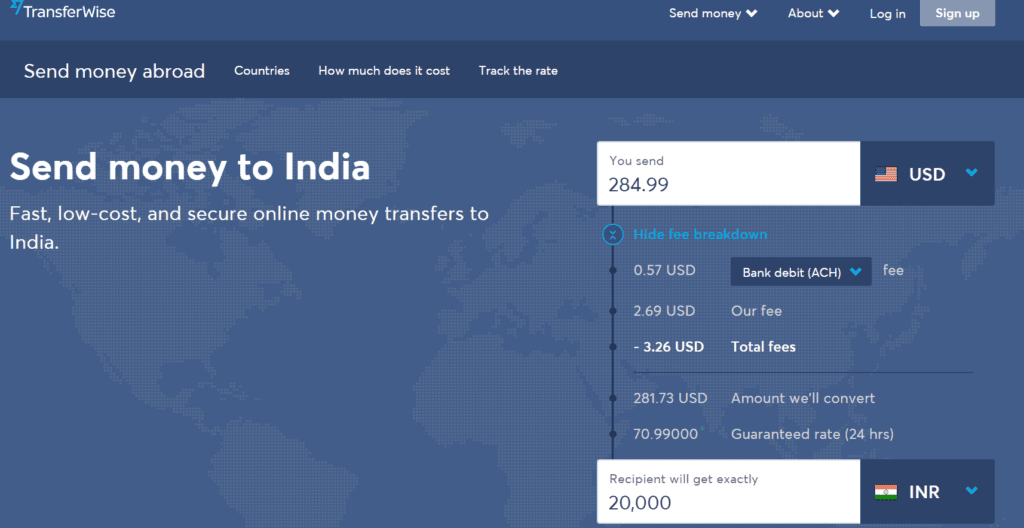

Transferwise

Transaction fee: No charges for freelancers in India. Client charges depend on the country

Transferwise is perfect for Indian clients that are actually based abroad. While you may be dealing with these clients in INR, they still have their money as foreign currency and that’s how they need to pay.

With Transferwise, the clients get the exact real-time exchange rate and they also get to know exactly how much they need to pay in their foreign currency to send the discussed amount to you.

For instance, if a client needs to send INR 20,000 to you, Transferwise will calculate everything else for them, so that you can receive the exact amount with no deductions.

The payments are usually cleared within a few hours on weekdays. On weekends, it can take some time for you to receive payments.This is also the best option if you have been wondering how to receive payment from US to India.

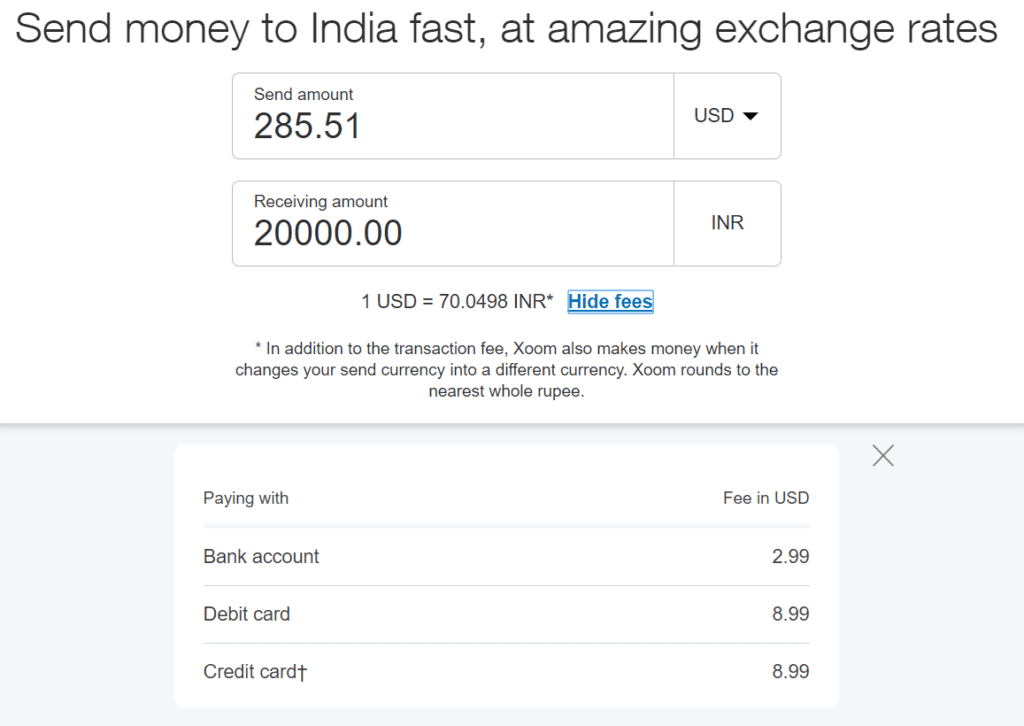

Xoom

Transaction Charges: No charges for freelancers in India. Client charges depend on the country and mode of payment

Xoom is also similar to Transferwise, just with a higher transaction fee. The only difference between them is that, Xoom is now a PayPal company and that is why it also supports PayPal payments apart from bank accounts, credit cards, and debit cards.

Choose the best freelancer payment methods that work for you

You should discuss the best freelance payment methods with your clients before you start the project to make sure there aren’t any confusions after delivery. After all, freelancing in India is a big challenge in itself and you should always be clear about how to receive payments as a freelancer in India

6 thoughts on “How to Receive Payments as a Freelancer in India”

This was a very helpful article for a freelancer like myself! Thank you for the great read 🙂

Glad you liked it 🙂

I have a query in freelancing. I want to start a side hustle but I am stuck in the payment method. Below are some of my questions.

1. Is it legal to accept international payment in savings account?.

2. As a freelancer what’s the best payment method ( Payoneer , PayPal)

Kindly help .I am totally clueless.

Hi Tanu!

1- Yes, it is absolutely legal to accept international payments. A lot of freelancers and businesses do it everyday

2- It depends on where your client is based. If you have international clients, urge them to make payments through Transferwise or a similar service since that way you get paid the full amount in your bank account.

Both PayPal and Payoneer deduct commission fee at the sender and receiver side

I don’t think TransferWise allows receiving payment in India from abroad.

What do you say?

Hi Ritika,

I want to do online jobs for part time. I’m just a good typist bot no other special skills. I joined freelancer.com. But when I bid, they always ask me to deposit first. I just don’t understand about this. Are they scammer or just needed to be done by the rule? Can you help me please?