Goods and Services Tax is an indirect tax in India applicable to the supply of goods and services within and outside India. It was introduced in 2017 to replace the indirect taxes levied by central and state governments separately, resulting in double taxation.

While GST was introduced to simplify indirect taxation, GST for freelancers has been somewhat confusing.

Here’s everything about GST you should know as a freelancer in India.

Definition of a freelancer under GST

There is no separate definition of a freelancer under the GST Act.

Any person who provides services to another person on a contract basis is known as a freelancer. They are not employed by a single company or an individual business owner — freelancers are self-employed and provide their services to several companies/ business owners simultaneously. Since freelancers are not regular employees of any organization, employment laws do not apply to them.

However, as service providers, freelancers fall within the ambit of GST provisions.

So whether you are a freelance content writer, a website designer, or a marketing consultant, you will fall under this category.

When should a freelancer get a GST registration?

GST registration refers to the process through which a taxpayer can register under GST.

A freelancer should obtain a GST registration once they meet the turnover threshold, as follows:

- If your turnover is more than INR 20 lakhs in a financial year (or INR 10 lakhs in the case of special category states), you must get a GST registration, regardless of where your clients are located.

If you provide services of less than or upto INR 20 lakhs in a financial year (or INR 10 lakhs in the case of special category states), you don’t have to get registered under GST mandatorily. This rule applies regardless of whether the services are being provided within the state where you are registered, another state, or outside India.

Freelancers providing services covered under Online Information and Database Access and Retrieval must also get a GST registration.

Advantages and disadvantages of GST

Here are a few advantages and disadvantages of GST in India at a glance:

Advantages of GST

- Eliminates the need for small businesses to comply with different indirect taxes

- Eliminates double taxation that increases the hidden costs of doing business.

- Minimizes tax evasion

- Mandatory registration linked to a higher turnover exempts a large group of service providers liable to pay VAT and service taxes.

- Service providers can claim input tax credit to reduce their tax burden.

Disadvantages of GST

- Business owners need to appoint tax professionals to ensure GST compliance. This increases operational costs.

- Registering under GST, raising invoices with the GST component included, and filing returns can be overwhelming and time-consuming.

What is the minimum limit for GST registration?

Registration under GST is linked to the annual turnover of the service provider.

There are two types of registration in GST:

Mandatory registration

GST registration is mandatory if:

- Your turnover exceeds INR 20 lakh in a financial year (INR 10 lakh in a financial year for special category states)

- You provide services covered under Online Information and Database Access and Retrieval services, such as advertising on the Internet, gaming services on the Internet, cloud-based services, selling e-books, music, or movies, etc.

- You are carrying out any inter-state supply of goods/services.

Special category states include:

- Uttarakhand

- Arunachal Pradesh

- Assam

- Jammu & Kashmir

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

Voluntary registration

If the annual turnover of a taxpayer is less than the limits specified above, they can choose to register under GST. Once registered, the taxpayer is subject to all GST provisions, including paying the applicable GST and filing returns.

Which GST rates are applicable to freelancers?

The applicable GST rate depends on the type of service provided.

Currently, the GST council has categorized the various services provided in India into four slabs 5%, 12%, 18%, and 28%. There is also a nil-rated slab with a GST rate of 0%. You can use any GST rate calculator or visit the government website to find the applicable rate for your service.

While digital services such as content writing, website designing, digital marketing, and virtual assistance are not explicitly listed, all services provided via the Internet usually attract a GST of 18%.

Since 2019, the government has also launched a composition scheme for service providers with a turnover of less than INR 50 lakhs, where the GST rate is 6%. While some freelancers may benefit from the scheme, it can be challenging for content writers or digital marketers, as services provided to a person in a different state or country are excluded.

What is the process for GST registration for freelancers?

Registration for GST for freelancers can be completed online through the GST portal.

Here’s a brief overview of how to generate your GST registration certificate:

Part A

- Select the ‘New Registration’ option from the drop-down menu of the GST portal.

- Fill up the application form by entering the legal name of your business as indicated on your PAN card and the email ID of the authorized signatory.

- Click the Proceed button to begin the verification process.

- Enter the OTP received on your mobile number and email when prompted

- Once the OTP is verified, the portal will generate a GST Transaction Reference Number (TRN).

Part B

- Log into the GST portal and click ‘Register’ under the ‘Services’ menu.

- Click on ‘Temporary Reference Number (TRN)’, enter the TRN generated, and click the ‘Proceed’ button.

- Enter the OTP received on your email address and registered mobile number and click on ‘Proceed.’

- You will be able to see the status of your application. Click on the Edit icon to upload the documents needed for GST registration, as listed below:

- Photographs

- Proof of business address

- Bank details (account number, bank name, bank branch, and IFSC code)

- Authorization form

- Constitutional documents for your business

- Submit the documents, visit the ‘Verification’ page, and tick the box for declaration.

- You can submit the application through an electronic verification code, uploading a digital signature certificate, or e-signing.

- Choose the appropriate option and complete the submission. You will receive an Application Reference Number (ARN) on your registered mobile number and email ID.

You can use the ARN to track the status of your GST registration application. Usually, the GST registration certificate is issued within seven days of generating ARN.

The certificate also includes a Goods and Services Tax identification number or GSTIN for freelancers. GSTIN is a unique 15-digit number issued to every taxpayer.

Read: Income Tax for Freelancers in India

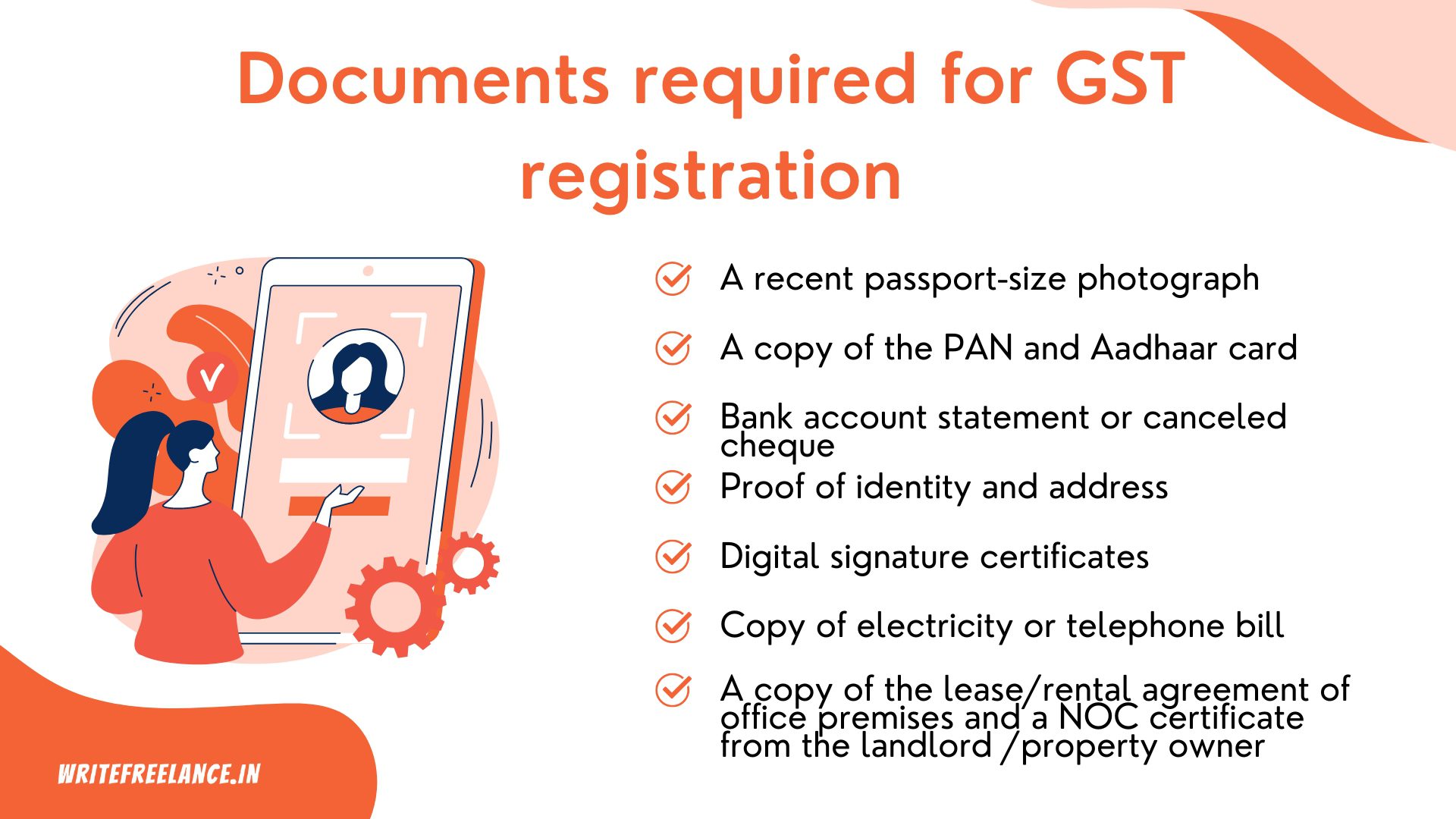

What are the documents required for GST registration?

Here is a list of documents for GST registration for freelancers:

- A recent passport-size photograph

- A copy of the PAN and Aadhaar card of the freelancer

- Latest bank account statement or a canceled cheque

- Proof of identity and address

- Digital signature certificate

- A copy of utility bills such as electricity or telephone

- A copy of the lease/rental agreement of office premises and an NOC certificate from the landlord /property owner/lessor stating that they have no objection to the taxpayer using the premises for conducting business

What happens after GST registration?

Once registered under GST, every invoice you raise should include GST on the total bill amount– which, in the case of freelance writers, B2B SaaS writers, or consultants, will be 18%

For example, if you are billing your client for INR 20,000, the invoice should include GST calculated at 18% and indicate that the total amount payable is INR 23,600.

Make sure that every invoice has a unique number and includes your GSTIN.

Once you receive the payment, you must file your GST return and deposit the GST amount to the government through the GST portal.

Also, note that your client may pay your invoice after deducting TDS for freelancers at 10%. However, their liability to deduct TDS does not affect your right to charge GST. Check out our guide on how to make a freelance invoice to understand how to incorporate GST into your usual invoicing process.

Do I charge GST to overseas clients?

If you provide services to overseas clients and they pay you in any currency other than INR, you have no liability to charge GST.

For example, if you are a freelance writer with clients only in the US, UK, and Australia and your total income when converted is INR 50 lakhs, your GST is 0%. This also applies to GST for freelance work for overseas clients via online marketplaces like Upwork, Fiverr, Freelancer.com, etc.

Ensure to get a foreign inward remittance certificate proving that the payment is indeed in foreign currency, and also make a zero GST filing every month.

But if your overseas client pays you in INR from a bank account in India, you have to charge GST if you are mandatorily or voluntarily registered under GST.

According to CAs, freelancers who exclusively provide services to overseas clients and have an annual turnover of more than INR 20 lakhs should mandatorily register under GST, even though they have no obligation to charge GST from clients.

For instance, if you offer content marketing services only to clients based out of India and paying you through bank accounts registered abroad, you will not be liable to charge them any GST for your services.

Is a freelancer eligible to claim an input tax credit?

Under the GST Act, input tax refers to the goods and services tax that a person pays while purchasing any goods or availing of any service used while running their business. When a person has to pay GST, they can deduct the tax they have already paid for the inputs and only pay the balance.

The GST Act has no special provisions for input tax credit for freelancers. Tax practitioners suggest that freelancers can claim the input tax paid for goods they use for services, provided they are registered under GST. For example, the GST paid on the laptop purchase can be claimed as input credit when the freelancer discharges their GST liability.

If you are an unregistered freelancer, any GST paid on purchasing goods for providing your services will count as a cost.

Conclusion

Whether you are beginning your freelancing journey or a seasoned professional — there is no escaping GST. However, figuring out GST compliance and file returns may look intimidating.

While you can always log on to the GST website and do it all yourself, hiring a chartered accountant who works with freelancers and solopreneurs will ensure that you never find yourself on the wrong side of the law.

FAQs

What are the penalties under GST for freelancers?

Freelancers attract the following penalties if they are liable to register under GST but do not register themselves.

- INR 25,000 for non-registration, and

- INR 100 per day for not filing the returns

Freelancers who register themselves under GST but do not discharge their tax liability or file their returns on time also attract penalties as follows:

- INR 200 per day for late filing of annual returns

- 18% interest per annum, applicable from the next day of the due date, for delayed GST payments

If a freelancer registered under GST doesn’t continuously file returns for six months, their GST registration may be suspended. Such freelancers can only undertake activity once the suspension is revoked.

Do freelancers need to pay GST?

Indian freelancers must pay GST when their turnover exceeds INR 20 lakhs/INR 10 lakhs in special category states) in a financial year.

If a freelancer who doesn’t exceed the specified turnover voluntarily registers under GST, they are also obligated to pay and collect GST and file returns on time.

Do freelancers need to pay both GST and income tax?

GST and Income Tax are separate tax liabilities. Income tax is a direct tax liability, and it is levied on the earnings. GST is an indirect tax liability levied on goods and services provided.

Every freelancer’s income is subject to income tax unless it falls within a salary bracket exempted from paying such tax. This is regardless of their liability to pay GST.

How does the GST affect freelancers?

Like any other service provider, freelancers are also subject to provisions of GST. Usually, a GST of 18% applies to the services provided by freelancers.

If you are a registered freelancer, collecting GST from the service recipients and depositing it with the government can cause cash flow issues. This is due to the lag between receiving the payment and the deadline for depositing the amount to the tax department.

Your freelance income may also get impacted if your customers do not agree to pay GST, forcing you to go out of pocket to discharge the tax liability.

What is the GST exemption limit for freelancers?

Freelancers with an annual turnover of up to INR 20 lakhs/ INR 10 lakhs are exempted from mandatorily registering under GST.

131 thoughts on “GST For Freelancers in India – Updated 2024”

Excellent Ritika…I think you are first to give this useful info for freelancers.

Thanks Manoj!

Thanks for your information.

Thanks Tejas!

This is very well written. Thanks for this.

Couple of clarifications.

1) If you have a combination of income from foreign and Indian clients, you need to only calculate revenue from Indian clients for the threshold of Rs. 20L?

2) I may have clients from only one state for now, but tomorrow I might get from another. Do I register for GST then or should I do that now itself? If I can register afterwards, then do I register before raising the invoice and hence irrespective of whether I actually get paid or not?

3) Similarly, what if I am registered for GST in some states, and get a new client in new state? Then can I register after I get the payment from the client of new state? (I hear that you have to register for GST separately for each state that you have clients in)

4) This rule of having to register for GST even if you are below the threshold of 20L if you have clients in multiple states is very weird. What’s government’s justification to it? This is not helpful to a small guy at all. Cost of keeping a CA itself will wipe out the income.

Hi Mukesh

1- Yes, only Indian clients are taxable.

2- If you plan to get more clients in different states, its best to register now. You will have to provide your GSTN number when you charge 18% GST, so you would need registration before raising the invoice. Also, GST registration is a 1-2 week process. You can’t register now and get your GSTN the next day

3- You don’t have to separately register for GSTN in all the states. Just once.

You just file for returns in different states, that’s something your CA will manage. So you won’t have to worry about all that

4- Yes, you are absolutely right. I mentioned the same in the article as well. This is going to create a big problem for new freelancers

I work on upwork and upwork converts and sends money to my account in INR (all my clients are abroad) does GST apply to me? I have receipts from that xx $$ converted to YY INR and send to zz account. Like paypal odesk sends in INR.

No,since your clients are abroad, you won’t be liable for GST. Though, do keep the dollar to INR conversion receipts with you for reference

Dear Ritika

My views are slight different on GST on export to other countries.Registration is required when you are exporting to other countries irrespective of any monetary ceiling of Rs.20 Lac. This is applicable in GST though this was not required under service Tax earlier.Process is a little bit complected in earlier stages though if not done it will be very troublesome in coming future.Below are some highlights.

1. Freelancer exporter needs to be registered under GST.

2. Freelancer exporter having turnover more than 1 crore last year can export without charging GST by submitting letter or undertaking to custom.

3. Freelancers having income less than 1 crore can export without GST by submitting bond of 15% of value of GST involved.

4. They can export by charging GST and pay the GST from own pocket and 90% of IGST will automatically come to their account after filling the returns rest 10% will be released on production of documents.

5. How the exporter will be certified: STPi is the authroized agency to certify export. You have to submit annexure, copy of invoice and number generated from rbi website to STPI. They will certify the same.

6. You will get advice from bank for remittance received from country of export.

7. Submit the advice and softex/invoice to bank and they will issue you the realization certificate of export and documents are complete now. Once you file your gst returns you will get the refund of IGST paid.

You must be thinking that cost of compliance will be high, yes I agree but you will be eligible to take credit of GST paid on various services like Telephone,lease line, office rent,computer and other asset purchased etc which were not there earlier and cost of compliance can be easliy met from there.

This can be elaborated further at good length and in good words,give me a pardon for this.

Hi Pardeep

This is valid for the export industry but freelancers come under the service industry

In case the freelancer is EXCLUSIVELY dealing with export of services and has no income from the domestic market, it is not mandatory for them to get registered at all.

In support of my argument, I quote the following link coming directly from the Central Board of Excise and Customs website FAQ: http://www.cbec.gov.in/resources//htdocs-cbec/gst/tweet-faq.pdf;jsessionid=03DB5C1D276516C077E7D2314A897E84

Specifically, read the Answer to Q17 which reads: “There is no liability of registration if the person is dealing with 100% exempt supplies”.

Everyone, please share your thoughts/inputs and please do correct if I am wrong, thanks.

Yes, that is exactly correct 🙂

Sometime, it is mix of export and domestic like on platform like freelancer.in, there are some Indian clients and others are foreign. Additionally, money coming into my account is via freelancer who converts all currencies into INR and then transfer into my bank account.

So will I have to pay GST for Indian clients in this case

Your article answers most of the queries. I am working as freelancer with one of Software Company Client and work on Contract. Our Bank accounts are in same city.

My Query:

1) My overall income for year does not exceed 12 Lacs, I am eligible to pay GST?

2) Client used to cut 10% TDS on every invoice that I make

3) Now with GST, Client says to cut 10% TDS and 18% GST? Is it correct?

My Understanding is, Client can deduct 10% TDS and pay the invoice and as I am under 15 Lac, I must not bear GST. I can pay my income tax dues.

If its in the same state, then you don’t have to file for GST unless you exceed 20 lacs. There will only be 10% TDS which will be deducted from the client side and you can file for its refund in your income tax return

Hi, the information is nice!

Is it still the same in 2020? All my clients pay me via Upwork and all of them are outside India.

Hello Ritika,

Thank you for the most simplified guideline for the freelancers in India. But I have a couple of questions.

1) If I do business only with the foreign clients and my yearly turnover is below 20 lakhs, do I need to register for the GST?

2) If I am still doing business with foreign clients and my turnover crosses 20 lakhs, do I then need to register under GST?

I will be waiting for your reply and thank you in advance.

As far as I know, the income you receive from foreign clients is non-taxable. The government does this to allow foreign currency to enter the Indian market and make it easier for foreign investors to put their money in India. Though, I am not 100% sure about the above 20 lacs thing, I would suggest confirming it with a CA

Thank you, Ritika.

Glad I could help!

Hi Ritika, Are you saying the money I receive via PayPal which is converted to INR and transferred to my bank account is non-taxable? Income transfered to my bank account is liable for income tax, right?

Hi Vidya

I am saying you don’t have to charge GST over it. For full-time freelancers and solo entrepreneurs, the income tax slab automatically gets halved because of the provisions made by the government. So, if your annual income is 10 lacs, your slab is actually considered 5 lacs. The 50% deducted includes income from foreign payments, health insurance, SIP investments, your business expenses, and everything else. (I strongly suggest consulting a CA as he/she would be able to give you more in-depth information regarding this )

And now, as per the latest, it looks like PayPal is joining the GST bandwagon 🙂

Yes, I heard :/

Hello Ritika,

Thanks for the information. But I guess, Freelance Journalists are exempted from GST.

Source: http://www.cbec.gov.in/resources//htdocs-cbec/gst/services-booklet-03July2017.pdf (Serial number 51 of ‘Nil’ section).

Can you please provide more info on this? Also though an ‘Independent Journalist’ does not have to pay GST, but do he/she still require a GSTN?

Any update on this can be very useful for the freelance journalist community.

Hi Sandipan

I am really sorry but I have no clue about GST rules for journalists as I am only focused on freelancer writers :/

Hi, Thanks for clearing my doubt through this beautiful article. I have some questions. >> Do the freelancers need to file income tax return? If yes, then on what basis and when.

>> If the freelancers get money through Paypal from foreign sources, then if the IT return is applicable to them? If yes, when?

Please help me for my queries.

You need to understand that GST is completely different from IT return. Whether you are charging GST or not, you will still be filing for IT returns. No matter what or where you are earning from, you have to pay taxes to the government. Even though GST is not valid for income being received from foreign clients

Need clarification.I am a retired engineer of 67 years of age and have been re-hired by an ESO operating from a SEZ at Bangalore. My annual earnings from technical advisor would be much less than 20 lakhs even when they keep renewing the contract. in this scenario there is a confusion about GST registration by ESO. As per my understanding I need not register for GST, however the finance team is asking me to register and then only raise invoice. Could some one clarify this.

Hi Kushal

If your and your employer’s registered place of work is in the same state then you don’t need to file for GST. They are probably forcing you to do that so that they can get GST credit

Hi Ritika,

Thank you for this post. Most of the articles related to GST are confusing, while yours is precise.

As a transcription service provider I get payment though PayPal from US and UK clients (12 lakhs per annum). As per your article,I don’t have to charge or pay GST.

Which ITR form do I need to fill for my income tax returns in 2018?

Hi

As I stated above, ITR is different from GST. So whether or not you are registering for GST will not depend on the type of ITR you fill

So if one earns 200ors from one state and 1000 from another and 200 from another. and like wise in total a person from state of Haryana works with 6 other states. so he/she has to register in all the states and then file 18 returns a month. That’s Killing the creativity of the person and drowning that person in paper work with is never an easy task in India. Plus Does a person below 20L and doing all outside india work need GST? I don’t see Govt having a clarity anywhere . Nor Ca.s have clarity and I don’t have the number of Hunuman to tell me what is what.

Unfortunately, there is nothing much you and me can do to change the tax policies. You don’t have to file 18 returns a month, that information is wrong. There is no extra paperwork as long as you were already keeping all your invoices in place (I recommend using an invoicing software)

Hi Ritika,

I am a freelance writer working from home in Ghaziabad, UP, for a company in Delhi. The company is asking me to pay the GST amount, as they cannot afford to pay GST to 40 vendors. They saying, lets bear the cost 50-50. What should I do? I am already in the process of GST registration, but still finding under which category and how to apply.

Should I register for GST (as they in different state). My annual income is 3.6 lakh.

Hi Deepti

Yes you should register for GST, but do not go into the 50-50 agreement.

As I mentioned above, when I client pays GST on the total bill, they get GST credit for it.

While they may be paying GST to you, they are also charging GST from their own clients. So the GST that they actually submit to the government is the (GST charged – GST they have already paid to vendors like you).

You will be doing the same thing.

So if you have charged INR 200 GST. The client will get that amount as GST credit and you will have to submit that amount to the government.

If you do 50-50, your client will get INR 200 GST credit, even though they only paid INR 100. And you will essentially be paying INR 300 for charges.

All in all, you will be the one getting paid less at the end of the day. And that’s exactly what your client is trying to do — getting you to decrease your rates.

Please let them know this isn’t allowed and its borderline illegal. It is mandatory for everyone to pay GST,those are the taxes laid out by the government. You don’t go to a restaurant and say “I will only pay 50% of the tax”

Hii, i provide web services to usa clients and my turnover is more than 40 lacs. Do i need to apply for registration? Even though my services are zero rated.

Yes, because your yearly turnover is more than 20 lacs per annum

Hello,

Freelancer providing their 100% services (tech/semi tech) out side India through online to students and other customers world wide from Delhi or any other part of India. No bill invoices are done to these customers and business volume remain very titular under 50$ or so for a job/service. And the amount is credited to banks in India through Pay Pal by deducting commission by the concerned brokers. in advise in such case to freelancers as what

– GST registration required. if so

– how the returns could be filed without bill invoices

– tax is being paid under section 44ADA as per amount credited to to bank A/c (Business less than 50 Lac pa clause apply)

– in case of business volume less than 20 Lac pa

– In case of business volume more than 20 Lac pa

Please advise on applicability of GST and other consequences.

If 100% of your income comes from outside India and you use paypal to receive payments, then you don’t need to file for GST, unless your yearly income is more than 20 lacs pa

Hey Ritika, great article, thanks!

Could you clarify on above statement again as PayPal will also start charging GST on each transaction and will need FICRs etc also

Hi Pravin, I am hoping to get the clarification on this soon. I will update the blog post when I do 🙂

Hi Ritika, I was having a NRI status in last financial year, I moved to India now and worked as a freelancer for a period 25 April 2017 to 15 Jul 2017 only and earned 11lakh. I am not sure about my annual income and NRI status in current financial year. Could you please suggest me the answer of the following questions in the present senrio. 1) Under which category should I register myself for GST

2) Do I have to pay GST on this amount, I reside in Gurgaon but I worked for a Mumbai based company. 3) can I pay the GST amount at the end of Financial year?

Hi Ashok

I don’t have much idea about NRIs to be honest. If you are filing taxes in India as a resident, then you are liable for GST. You could file it at the end of the year but you will be charged with a late fee, you need to be filing three returns every month

Hi, I usually do freelance writing for US/UK clients which is where most of my income comes from.

Now as per this article, it says as long as you don’t provide services to people in multiple states in India and your revenue is less than 20 lacs, you do not need to register for GST. I don’t foresee myself making more than 15 lacs per year at least in the next 2-3 years or writing for Indian clients.

However, on this link (https://np.reddit.com/r/india/comments/6rwc17/gst_freelancers_for_who_work_for_foreign_clients/), it says even for foreign clients, I would have to not only register for GST but file 40 GST returns a year and pay 18% GST on every payment I receive and then claim a refund.

Could you clarify this for me please?

Thanks.

The link you have shared is for export industry, not for the service industry

Working under a freelancer comes under the service industry. So no you don’t have to file for GST if you are just working with foreign clients. The Govt has intentionally made this rule to increase the inflow of foreign currency in the Indian market.

Also, there are no 40 returns, there are total 37. You don’t have to do anything really, these returns are automatic which can be taken care off by your CA

Thank you Ritika. I am in a similar situation where I am a consultant to a HK entity. Since it’s a contract that calls for fixed monthly payment, no invoice is generated and the foreign client has not paid any GST. Do I now have to pay GST on the amount received or am I liable only to pay only the advance tax on my income?

Hi Savita

No, you don’t need to pay or register for GST. Income tax is a whole different subject though

How is commission received from foreign clients – to be treated for GST.

Is the criteria , that commission received is in Foreign Currency and client is overseas enough or do other things matter ?

Like where does you client use these services – for doing business in India or ……

How can we tax a foreign entity or do we end up paying from our pocket ?

The golden rule all over the world is – you cannot export taxes !!

Hi Ritika, Thank you for the detailed article. I provide freelance service to a client in another state so I will charge applicable GST for my service. Now the client finally delivers that product/project to a foreign client. My question is that would my client be able to get input tax credit back, or does he/she have to bear the tax burden?

For you, the transaction stays between you and your client only. What the client does with the work delivered by you is out of your spectrum. You will charge GST on the total amount and if the client is registered for GST as well, then they can get an input tax credit over it.

Hi ritika. I am a freelance content writer for only a single client. My income is below 2 lacs per annum. My client wants me to get a gst number but considering that my work is not very extensive, I am confused whether it is really mandatory to get into the gst registration process. Please advice what I should do.

Dimpy, your client is probably forcing you to register so he can get tax credit. If you don’t think you need to register right now then you shouldn’t — Its your decision at the end of the day

Hi Ritika

Your article is enlightening. But I want to ask a few things. I work as a freelance content writer under a freelancing website. I have registered myself for GST.

The payment I receive comes with a deducted 18% GST charges and the commission from that freelancing website. I earn around 2.5- 3 lakhs per annum. Do I need to file for GST every month?

If you are already getting GST deducted then by registering for GST you can get that tax credit back and the GST paid also becomes non-taxable. I highly recommend registering for GST as it will only save you money

Thank you so much for the information.

just have one question. I am a freelancer and produce animation on service marketplace where I receive money in my paypal from marketplace. And there is no invoice generates on my name, The marketplace gives invoice to the client on its name. I just receive my price after deduction of some percentage by Marketplace.

Now my income crossed 20L . Want to register for GST. ( If Yes. I have to )

Without any invoices from my name , How this will be filed. Because GST needs every invoice. Please help in answering this.

Depends on where your marketplace is registered. If its not registered in India,then you don’t need to register whether your income has crossed 20 lac or not. You cannot tax foreign clients

Hi Ritika,

I am a Digital Marketing Freelancer and I wanted to enroll for GST registration. I got to know that deadline for enrollment was 20th Aug, 2017. Though my income is less than 20 lacs per annum(way less as I have recently started freelancing), my question is how do I bill my clients in my state or city if I am myself not registered under GST?

You ca bill your clients but you cannot add GST charges in your invoice if you aren’t registered for GST. The registration date has passed but you can still register. Its just, there might be some late free

What if the services are provided to foreign client only and the client pays through a foreign bank? Is GST registration mandatory? What if the payment was decided before July 1 but initiated after?

GST is only mandatory when payments are made from an Indian bank account. You cannot tax foreign clients..It doesn’t matter when the payment was decided

Hi Ritika,

Thanks for your article and responses.

This is in reference to your last comment where you said “GST is only mandatory when payments are made from an Indian bank account”

I provide software testing services to a US company and receive fixed monthly wire to my bank in US dollars from their US bank account. Am I require to mandatory register under GST?

Since export of services are Zero rated supplies but do they come under “taxable supplies”? Since if they are taxable supply, one has to register as per section 24(i) of GST that includes “inter-state taxable supplies”.

Please share your thoughts!

Hi Sachin, you aren’t required to register for GST. I have also updated the article to be more clear 🙂

HI Ritika!

Today i got an email from Paypal. this is the link. https://www.paypal.com/in/webapps/mpp/ua/upcoming-policies-full

i am a data entry freelancer, one of my regular clients give me a regular income per month and i am filing ITR from last 4 years. my latest ITR was less than 9 lac. my all income is from this business.

please read the message from link, i am confused. do i need to opt for GST and provide same to the Paypal.

Thanks in Advance Ritika.

I tried talking the PayPal customer service, turns out they are confused as well. We will have to wait and see about this :/

I do freelancing for clients located outside India and get paid in dollars via PayPal, which gets converted into INR and paid into my savings account. My annual turnover is less than 10 lacs. I read export of services is exempt. Should I register for GST? I have today received a policy update from PayPal stating they will charge 18% GST to be compliant with Indian laws. This is all too confusing for me. Can you please give me some clarity? Thanks.

PayPal charging for GST does not mean that you should be registering for GST. Just because you buy a laptop with GST charges for your business, doesn’t mean you need to register for GST.

If you only receive income from foreign clients, you don’t need to worry about registration

“If you only receive income from foreign clients, you don’t need to worry about registration” – is this applicable even when we have paypal desposits crossing 20-30 lacs annually?

Yes

Hi, I have a question. If I earn income through Amazon US (affiliate marketing) and they send me payments, do I need to register for GST? Most of the traffic on my website is from the US. But I’m not directly offering services like freelance writing, it’s more like blogging, with ads.

Hi Jatin

This I am not sure about because Amazon is registered in India as well and they might be sending you money directly from their Indian holding, in which case, you will have to register for GST. I think its best to contact the Amazon customer care regarding this

If it’s from the US holding then I wouldn’t have to register? Some people tell me I do, regardless

No you don’t need to register if payment is coming from a foreign bank account

Hi,

As an affiliate marketer, would I have to register for GST? I have a website with traffic outside India, and I get payed in US dollars from the Amazon US company.

Hi Ritika, I am a freelancer who provide services in Presentation Designing in India and to overseas clients as well. I have not registered for GST till now as I was not aware about the clause which says if I am providing freelancing services to inter state clients I need to have GST number. Now, my question is that my turnover is below 12 lacs and it is not gonna increase in coming 1-2 years. So now,if I apply for GST..will it become liability for me and on each and every Invoice I need to charge GST??? or should I charge GST only to inter state client and not to my state client???. Kindly suggest. Thanks, Monika

If you are providing services in different states (other than your home state), then you have to register for GST. When you register for GST, you will have to charge GST to both clients in your state and other states.

For clients in your state, GST charges will be added as — 9% CGST + 9% SGST

For clients in different state, GST charges will be added as – 18% GST

But, you will be charging the same GST for all clients

hi. i receive money from my foreign clients to my paypal. few days ago paypal announced GST, will they deduct 18% in money i receive from foreign client when i move the fund from paypal acc to bank?

Hi Ritika,

Are you sure that GST is not applicable if the payments are solely coming from overseas clients via PayPal? Some people commented on the change.org petition that overseas payments will be considered as inter-state. I think that’s absurd and your assessment seems to make more sense to me. I know there is a lot of confusion around this topic and I was wondering if you have any new updates on this. Thanks.

No GST registration is not applicable on PayPal payments.

PayPal may be charging GST over their fees. Though nothing is confirmed yet. I am waiting to hear from them

Export of services to international clients has been termed under interstate services, which means its mandatory to register for GST, even though export is zero rated. How would an individual freelancer operating under a brand name be able to register for GST? What documents would be required?

You only have to register for GST if you are receiving payments from an Indian bank account.

I think you just need your Aadhar card and PAN card for registration

Thanks for the informative article, this is really useful.

I work as an independent contractor with an overseas client. I have > 20L income. Do I need to register for GST? Do I need to pay 18% GST and wait for a refund even though I can’t charge the same to my client? Are freelancers who work for foreign clients being timely refunded for 18% GST they pay (as service they provide is zero-rated)? There’s a huge confusion around it, as you can see in this discussion: https://www.reddit.com/r/india/comments/6rwc17/gst_freelancers_for_who_work_for_foreign_clients/

Would really appreciate if you can comment on it.

There is no confusion about this. I have personally asked a lot of CAs – You don’t need to register if you are getting payment from overseas

Thanks Ritika. Few CAs (including mine) are claiming we need to register under below clauses:

IGST section 7(V): Export of services outside India will be taken as inter-state supply of Goods

CGST Section 24 (i) mandates registration of person engaged in inter-state supply of goods and services.

Can you post relevant sections from IGST, CGST which say individual (s/w) contractor getting foreign remittance (> 20L) don’t need to register to GST?

It will really help entire community.

Do I need to register for GST?

YES and no limit applies. 1 Lakh or 1 Crore.

Do I need to pay 18% GST and wait for a refund even though I can’t charge the same to my client?

You file for nil return and no need to pay taxes.

Are freelancers who work for foreign clients being timely refunded for 18% GST they pay (as service they provide is zero-rated)?

You pay no taxes and you get tax refunds as input tax credits to your bank account.

Hi Ritika,

I am working as a freelance illustrator and my designs are licensed by a company in the US who pay me via paypal, which the amount then gets deposited into my account here.

My earnings are well below 20lakhs annually.

Unsure whether I would be required to register for a GST number or not.

Hi Namrata, you don’t need to register 🙂

Thanks for your article but can you please give us the source / proof. Some people are saying exporters need to register despite of their income limit.

Ritika. The information is very useful. It has cleared my doubts on some of this mumbo jumbo stuff. I’m retired, an old bloke, earn a few pennies monthly doing some transcription work for an overseas client. This rarely crosses 5K now. How does this impact me? From example, my November earnings was just Rs. 3109.26 (after Paypal’s fees). This money I received. Now, I had an email from PayPal today that my November ’17 tax invoice was ready for download. Clicked the link, downloaded. The statement says “Charges for services provided for the period from 1 November 2017 to 30 November 2017” INR 288.82. IGST(18.00%) 51.99 . Total 340.81. HSN: 997159 GSTIN: 27AAGCP4442G1ZF PAN: AAGCP4442G. What does all this mean? Do i have to pay that? Can I send you the PDF through email, or can you email me some advice? All this is making me very nervous, never had all these headaches before. thanks in advance.

Hi,

I have just started my digital freelancing work from home can I register for GST. As being a startup right now there is no client yet

Hi Ritika, I am a freelance copy editor. Would you know under which category or HSN code should I register?

Hi,

Do we need to generate invoices again at our end before filing for GST incase the payments are delayed by a month or so? For example if I generate an invoice in the month of August and I get payed in the month of Sept, does it mean while filing for GST I must generate the same invoice again with different dates?? This is a big confusion I am facing right now, any lead would be really helpful.

Thanks,

Ajay

Hi Ajay

I had recommend regenerating the invoice if the payments get late, since it doesn’t make sense to file taxes for a payment you haven’t even received. Its also best to let the client know about the same. I usually have a late payment clause in the contract which allows me to receive payments on time

Thanks,

Would it also create any issue if I dont inform client for the same? I mean when client claim for Tax credit on the GST that I paid, does they claim month wise or through invoice number??

Hi, I am a software professional earning more than 15 Lack. I also started doing freelancing where in my earning is not more than 3-4 lac, Do i need to file for ARN/GST number? also if No then how i can ask client to pay me? They do some TDS deduction on my amount.

Thanks for this, it was much needed, there is a lot of confusion going on.

I am a freelance software developer mostly get my income (>20L) from US clients. But I also have some Indian clients from whom I earn about <5L per annum.

What happens in my case? Do I need to register? and if I register do I have to add GST to my invoices to foreign clients too?

Hi Ritika,

Thanks a lot for the information! I’m a freelance Digital Artist & Concept Designer with all my clients abroad. Are you absolutely sure that international wire transfers, paypal etc are exempt from GST? That too regardless of the threshold?

If yes, then it would save me tonnes of trouble…

Thanks again!

Jayant

Hi,

I have been doing freelancing since last 5 years and work with most of the foreign clients. But I do have couple of Indian clients from other states but they are paying me through foreign platform such as People per hour or Upwork. So do I need to register for GST and do I need to pay for those Indian client who are making payment through platforms such paypal.

Please guide

If the money is coming from out side of India like through upwork or people per hour it falls under foreign clients.

Hi Ritika. Thank you for this article, it is very informative. I am a freelance writer as well and I was wondering if you could share details of any experienced, reliable and knowledgeable (in terms of freelancers) CAs in Mumbai who we can contact for further information and help.

Thank you,

Nadezna.

Hi rikita, I am a growth hacker and have account on freelancer.com as well some direct client across the world except India.

My earnings will be more than 1.5CR by end of the current fy year.

I file my IT return on time but always wondering about service tax and now GST.

By the way I am always looking for content writer 🙂

Can you also tell the process for registering for GST by self for freelancers? I am more into FB Ads but turnover less than 20LPA.

Dear friends

We have PayPal account. Today PayPal asked me to add GST.

But I am receiving personal gifts through from my friends. It is only less than 5 lac rupees only.

Can I need add the GSTIN ? Any solution.

Thanking you all.

Hi Ritika,

I noticed your update that now freelancers in India making less than 20 lacs are not required to register for GST. Can you show a source for this? It’s a surprising development.

Brilliant piece of information, Ritika!! Kudos!!

Just one suggestion:

Your 3rd scenario — “Do you have clients in a number of states across India and annual revenue less than 20 lacs?” — says “Registration not required”, but it is contradicting your example of “Maharashtra and Tamilnadu”. Please take a look at it & correct it to “Registration required”. 🙂

Thanks a tonne again!!

Hi Ritika,

I am a freelancer and I get a payment from US company. They pay me through PayPal. From October month PayPal is deducting extra 18% on both transaction fee and exchange rate. My income is less than 20L/annum. Will I be able to get a refund of it? If yes then what is the procedure.

PayPal is asking for my GST number. But should I register? I am confused. Please guide me.

Its was clear but this month I got notification from paypal that you can download your GST invoice for nov 1 to 30 and in PDF he mentioned 4033 for my To transaction $551 and $253 that I take from Upwork , I called him paypal and he reply that he is already deducting GST .

Can you please explain about this

Hi Ritika,

I am working as a contractor for a software company and they pay me <20lacs per year. I am not sure what they might be charging the client that I am working for. Its a foreign company they charge for me from. In this case, GST is applicable to my employer? They say that they are paying a heavy GST amount on behalf of me and so cant increase my pay.

Iam a freelancer working for fully for an overseas client for constructing and setting up servers for mobile apps development.. the thing is Iam getting money via forex only with more than 20 lakhs per year as a turnover. so let me know whether i still need to register for GST and if needed to do so then is there any exemption for it?

You have added to the confusion. In one para you write that for a freelance writer with clients in any part of India but with income below 20/10 lakhs need not register. But in the very next line you say that despite the earning” if your client is in a different state you have to register “

Please clarify

Hi Kamini, unfortunately its the GST committee that added to the confusion. This article was written in July 2017 according to the rules then.

The top ‘Update’ section of the article was added in October 2017 when the GST committee changed their ruling and said only freelancers who earn more than 20 lacs per annum need to register. Check out the updated post for more clarification – https://writefreelance.in/gst-freelancer-2018/

Hi, I am working in IT with 30% taxable salary bracket. Now I am also in parallel working as a freelancer for US and taking work. My employer is deducting my 30% tax as per my salary. The question is how should I pay my taxes for the freelance work? Will that be 1- presumptive tax scheme 2 – 30% on my freelance income or 3 –

GST? Please help. How should I pay Thank you.

You will pay taxes according to your total annual income. I think its best to consult a CA who can help you file taxes for the extra income

I’m about to release a video game which will generate revenue by Ads (so that will count as export). And if my turnover is less than 20lacs, and most probably it will be less than 20lacs, I won’t have to register according to your post.

But a post from Factor Daily says that, “If you are a service provider, ie blogger, and generating income from outside India (export of services), then GST registration is mandatory and exemption limit shall not apply,”

[Link redacted]

Are there two posts contradictory because the one from Factor daily is from June 2017?

Can you please clear my doubt?

Hi Shayaan, yes you are absolutely right. The two posts contradict because this post is from June 2017. The GST Committee later issued an update which said people that had turnover less than 20 lacs did not have to register at all (As mentioned at the top of the article)

Okay so what if I earn money by making my game paid, and not through Ads based outside India. There will be some purchasers of the game from India (different states), and some will be from outside India (which will count as export).

Will I have to register if my turnover is less than 20L?

Oh sorry! I just read your post correctly. I don’t have to register if my turnover is less than 20L.

But are you sure selling digital games comes under this? Because your new article kinda confused me where you said “These answers don’t apply to people offering export product or anything else.”

Because selling digital games is export I think.

Hi I am based at bangalore but a Hongkong company hired me as a consultant with a fixed fees of 80K/ month and since they do not have a legal entity in india for recruitment of cadidates from india and place them in Bangaladesh and Hongkong. I do not have a company or any establishment. Do i need to pay gst if not will i have to pay tds or other thaxes for the income i get?

I work for an IT company located in Sweden as a freelancer (I am a virtual assistant) from Bangalore. The monthly hourly fees for my services is paid into my bank account via TransferWise in INR. My invoice is raised in USD every month, the company accountant converts the total USD (as per the invoice) to SEK and pays the amount in INR to my bank account in India. My annual CTC is less than 20 lakhs. Should I register for GST irrespective of falling under than 20 lakhs bracket? Also, please let me know if I cross 20 lakhs as annual CTC should I register for GST?

HI Natasha, no you don’t have to register for GST

hi Ritikaji,

your article cleared almost all doubts only problem is some people are saying if i have a clients from different states i need to pay GST even if my revenue is less than 20 lacs ,

my yearly revenue through my freelance work is small and I pay whatever income tax i am suppose to pay on my income , should i pay GST as well, kindly clear my doubt.

thanks in advance

Hi Ravindra, no you don’t have to register for GST

Greetings, Ritikaji! Just to clarify the above query and your response — I have multiple sources of income, and freelancing (any kind of odd job, not only writing) is one of them… So, if I pay proper income tax on my other sources of income AND if my freelancing revenue is less than rs.20Lakhs, then i do not need to register for GST — is this correct? did i understand the concept correctly? Thank you!

Dear mam,

I am a part time freelancer working on and off. My income is very less. My clients are from different states and for every meager income they are deducting 10% TDS. Whatever i am receiving is less and after deduction its worse. If I am earning like anything dont bother in paying taxes. Kindly guide how to come out of this and grow in this field

Hi Sree

Your clients can only deduct TDS from your payments if you have provided work for more than INR 30,000 in one financial year

Hi, I have a doubt.

10% TDS has been detected already by client from total payment.

Should I now pay 18% GST from remaining payment?

My question is should both TDS and GST should be paid from my payment?

Hi Arvin

TDS and GST are different from each other, and they don’t impact each other.

TDS deducted from the client side when you have provided work worth more than INR 30,000 in one financial year. You can claim this TDS when you are filing for taxes.

GST is deducted from your end, if you have a GSTN

Hi. I provide online advertising service to overseas clients. I have registered for GSTN since payment gateway asked for it. Do I have to pay GST?

I only have overseas clients, do I have to register for GST. I read everywhere online that Registration is must if clients are not in the same tax state as mine

We work only on freelancer.in (web platform) website. There are projects listed by some persons, we bid on them. If the client accepts our bid value, we get project and after completion of the project money is transferred in Freelancer account. After that, freelancer deducts its introduction fee of 10%, TCS at 1% and rest is transferred to our bank account after converting all into INR.

Now, most clients are foreigners but some are Indians. As service export is zero rated. So for foreign clients, there is no tax liability but what will be liability for Indian clients.

1. Normal GST rate of 18%

2. Zero rated considering Freelancer as our client rather than the person directly as it is freelancer who is paying as indirectly.

Please guide me.